Multi Family Mortgage Rates Canada

You like many other canadians may have over ten thousand dollars charged to your credit card but if you only make the minimum required monthly payment of 2 per cent 200 the first month that 10 000 in credit card debt will ultimately take more than 57 years and cost around 40 000 dollars to fully pay off.

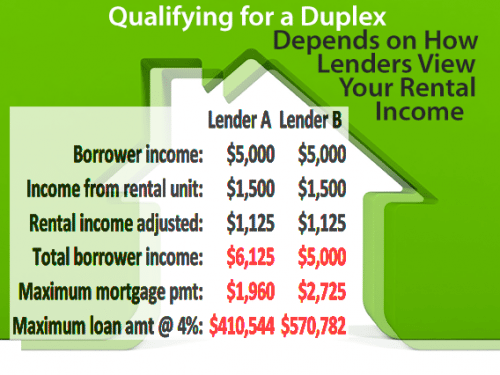

Multi family mortgage rates canada. Investors need a higher credit score and more cash reserves to qualify for a multifamily mortgage and will pay more in upfront fees or a higher interest rate on the loan. Credit card interest rates average at around 18 9 per cent. This 25 does not include the down payment for the property. These float with the canada mortgage bond rate and fluctuate daily.

Our expertise covers medium to large scale residential apartment buildings. Cmhc is the only provider in canada of mortgage loan insurance for the construction purchase and refinancing of large multi unit residential properties including rental buildings licensed care facilities and retirement homes. Our analysis will include the comparison of conventional multi family lending versus cmhc insured options. Cmhc insured and conventional commercial mortgages are available on multi family properties.

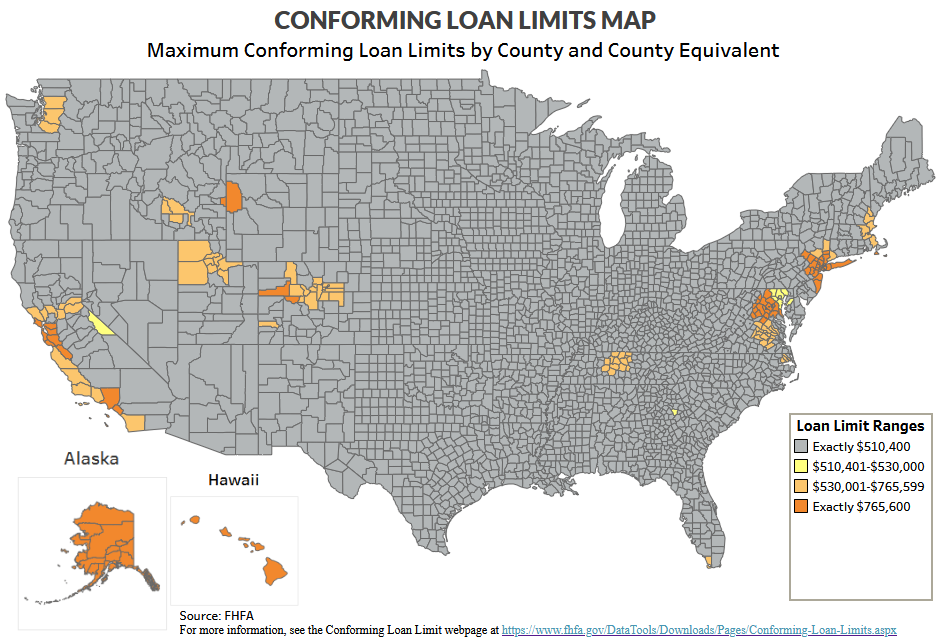

Apartment and multifamily loan rates range from 2 76 for a 35 year fixed fha loan to 4 65 for a 5 year fixed community bank loan. Canada mortgage and housing corporation cmhc the canada mortgage and housing corporation cmhc loan insurance helps borrowers with lower down payments purchase multi unit properties and may provide insurance up to 85 of the value of the property. Indicative rates for a five year term are currently around 2 53 per cent and around 3 33 per cent for a ten year term. One of the best interest rates is from a life company at 3 95 for a 25 year fixed.

In the multi family sector properties of at least five rental units cmhc insured rates were 1 57 for a 5 year term and 1 91 for a 10 year term for multi family mortgages under 5. The minimum net worth to qualify for a cmhc loan is 100 000. Compared to conventional rates these are usually around a full 1 per cent to 1 5 per cent less. We offer cmhc insured mortgage products for qualifying multi family real estate properties to allow financing up to 85 of the property value and amortizations up to 40 years.

In the middle is a 15 year fixed fannie mae loan at 3 65.