Nevada Revocable Living Trust Form

Nevada legal forms services is not a law office and is prohibited from providing legal advice or legal representation to any person.

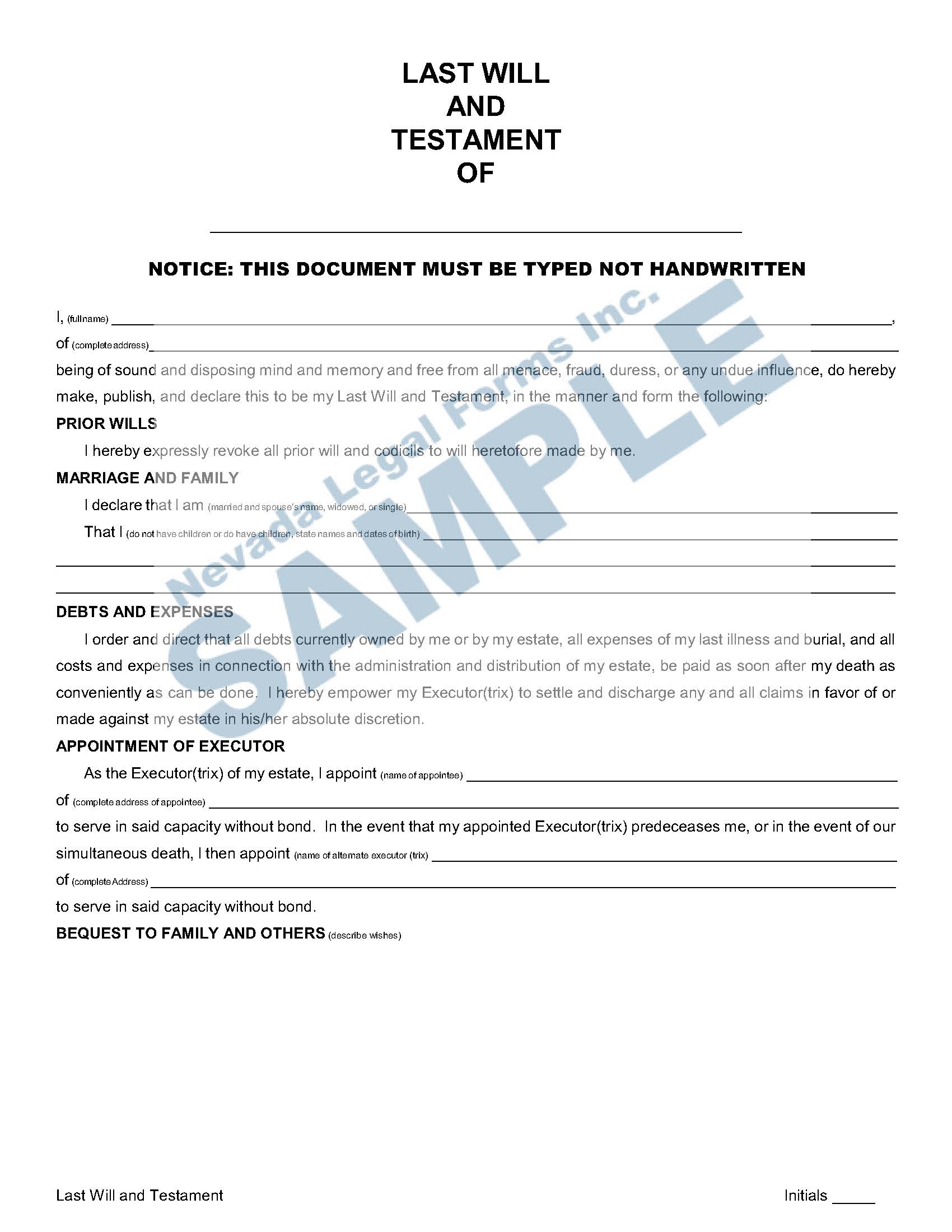

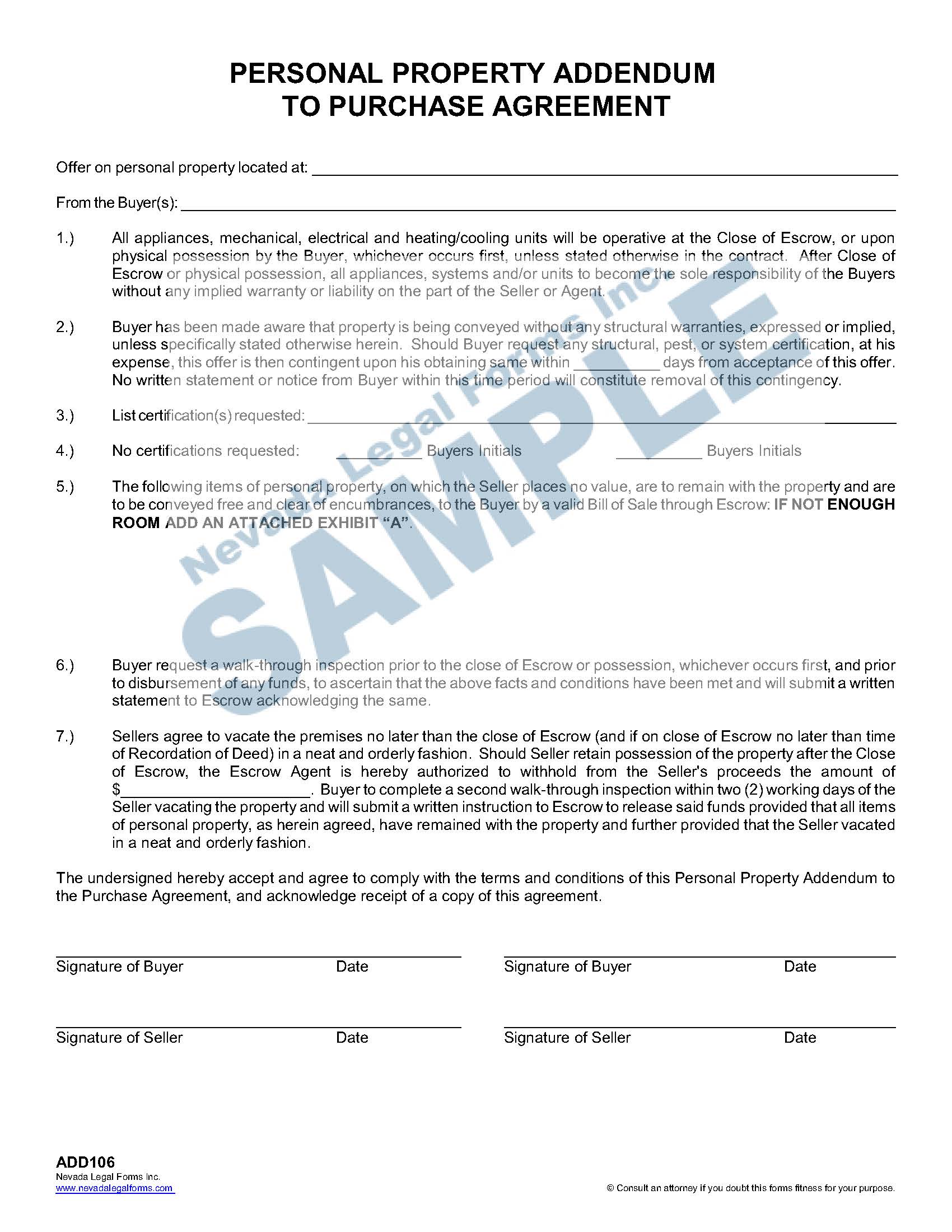

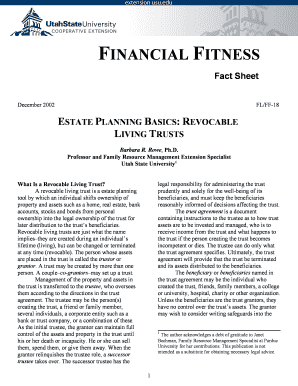

Nevada revocable living trust form. When the grantor dies the beneficiaries you ve named in that document receive the trust property. It is possible to avoid estate tax using specially constructed trusts called ab trusts also known as marital trusts or. A living trust is a trust established during a person s lifetime in which a person s assets and property are placed within the trust usually for the purpose of estate planning. Living trusts and estate taxes in nevada.

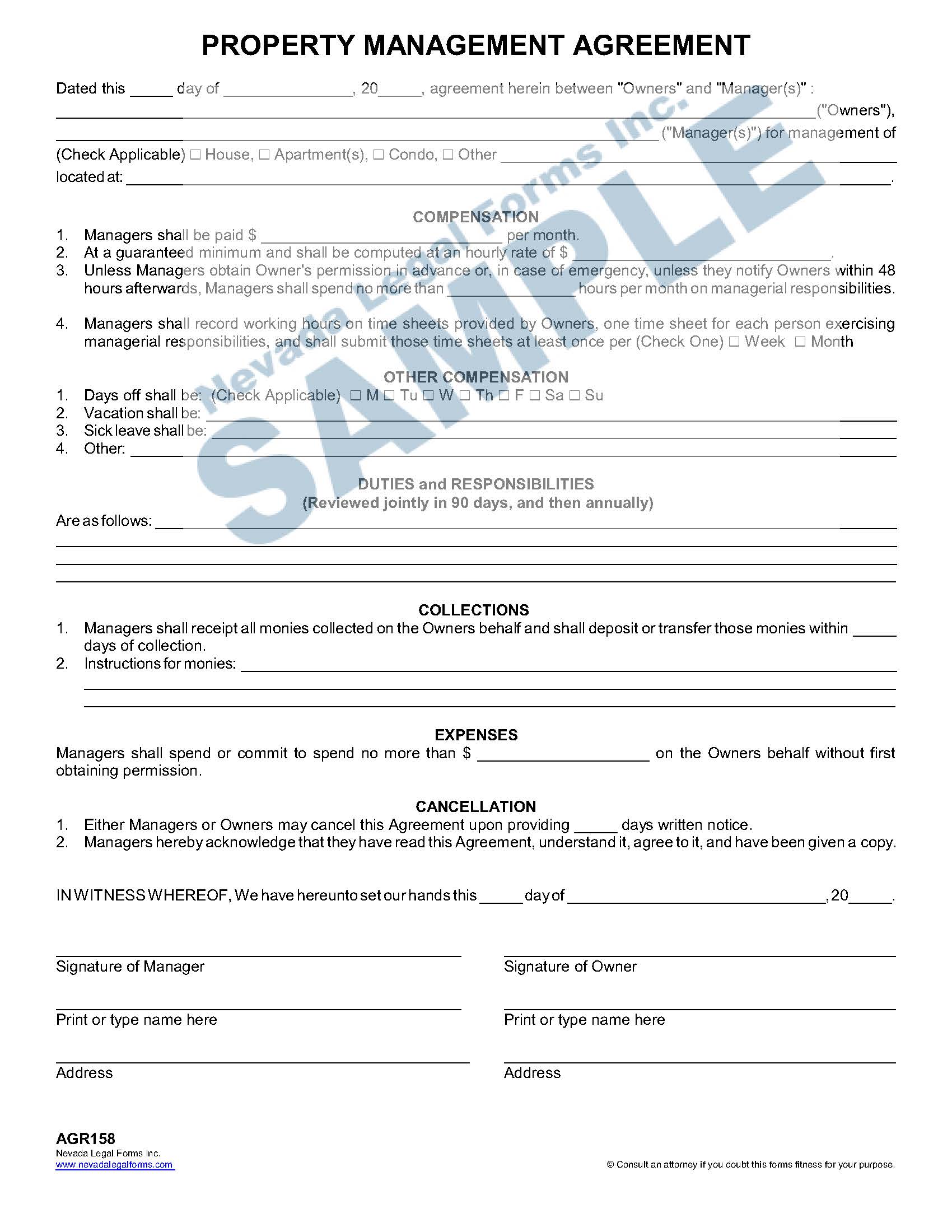

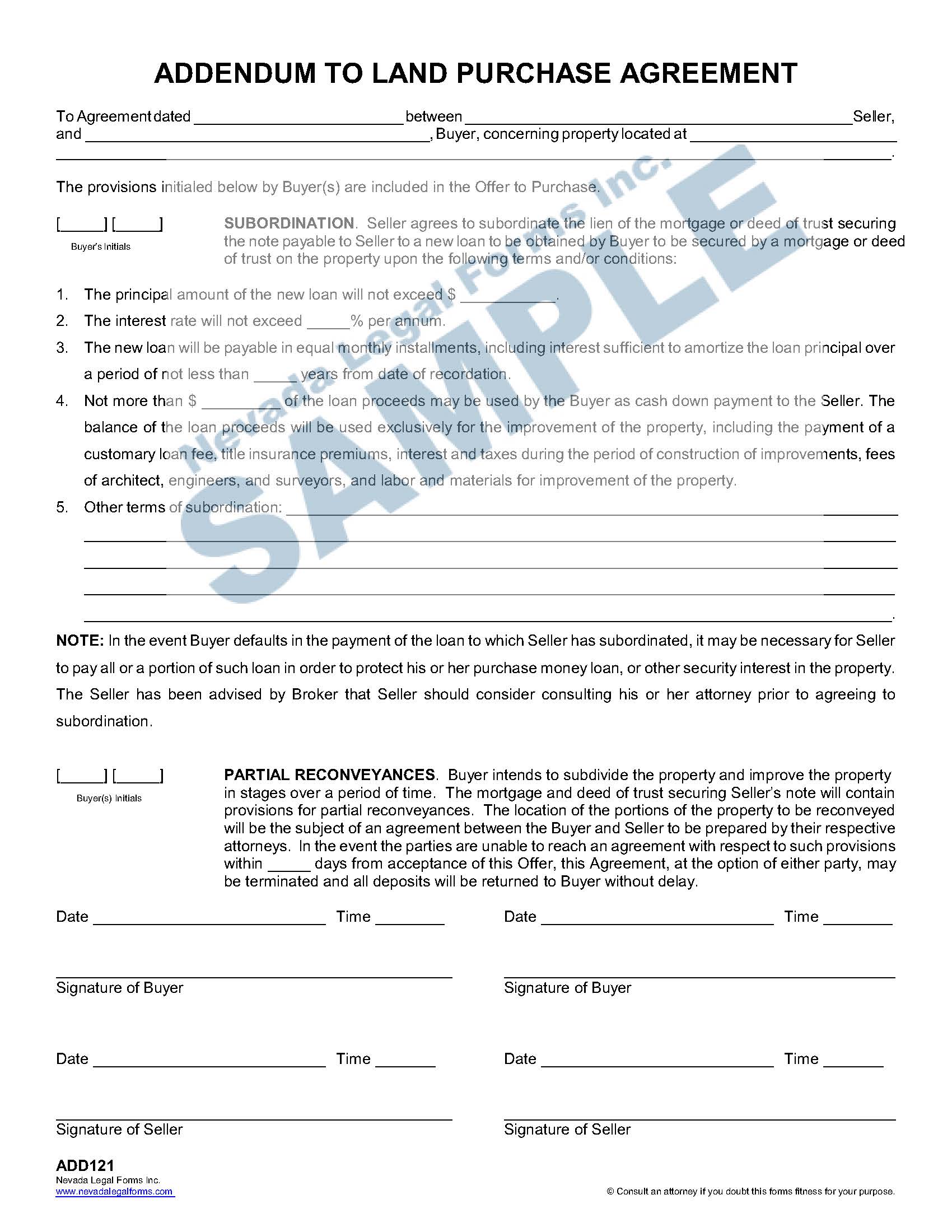

A nevada living trust allows you to do the same basic job as a will with the added benefit of avoiding probate. The agreement form will state the names of the parties and their roles in the trust the name of the trust the details of the property transfer as well as other clauses which are. The main advantage of making a living trust is to spare your family the expense and delay of probate court proceedings after your death. Dba nevada legal forms services is a document filing service and cannot provide you with legal tax or financial advice.

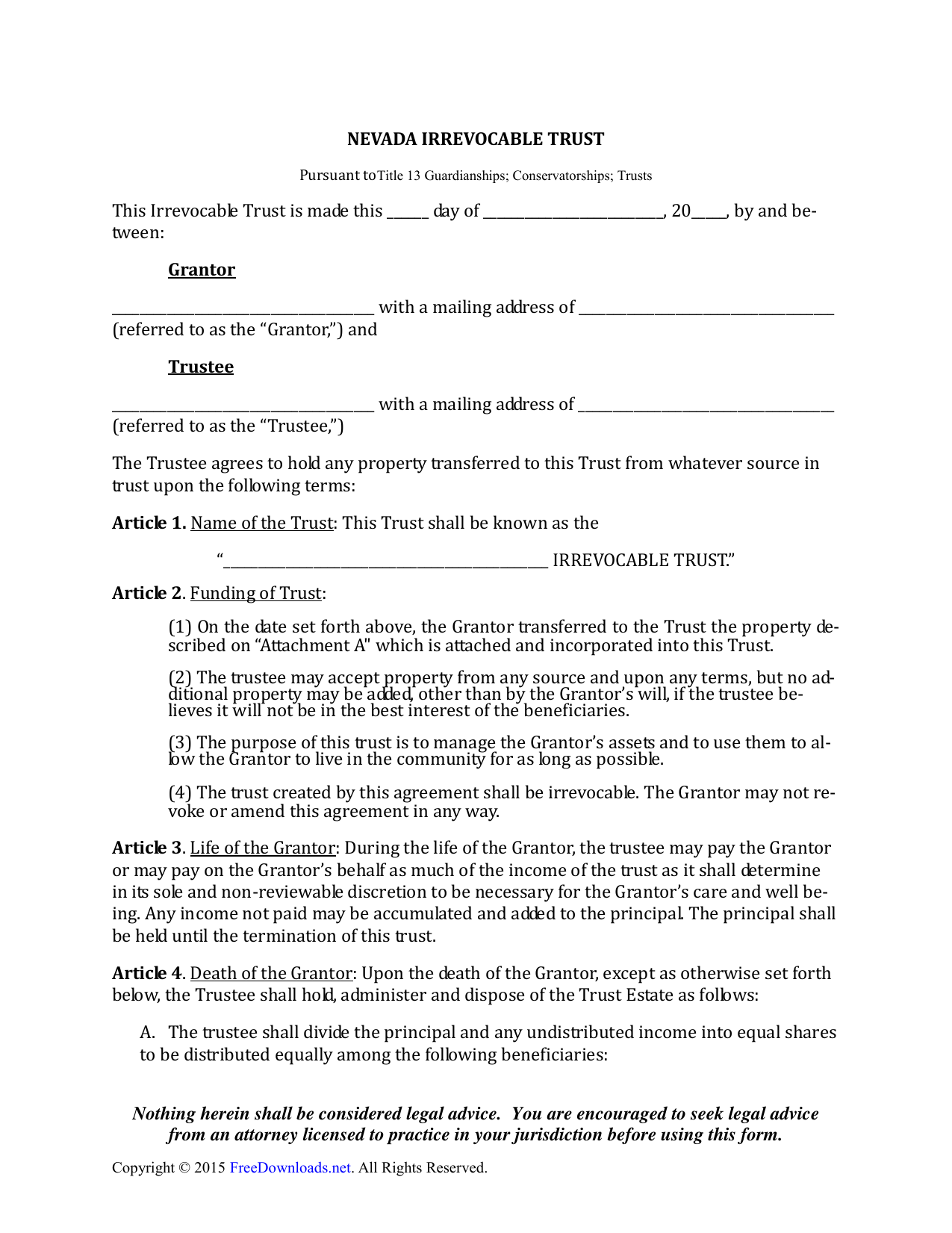

Nevada living trust forms irrevocable revocable the nevada living trust is similar to a will in that it provides direction on the distribution of assets and property upon the death of the document s creator. Nevada does not use the uniform probate code which simplifies the probate process so it may be a good idea for you to make a living trust. The term revocable means that you may revoke or terminate the living trust at any time. Your revocable living trust cannot protect you from estate taxes.

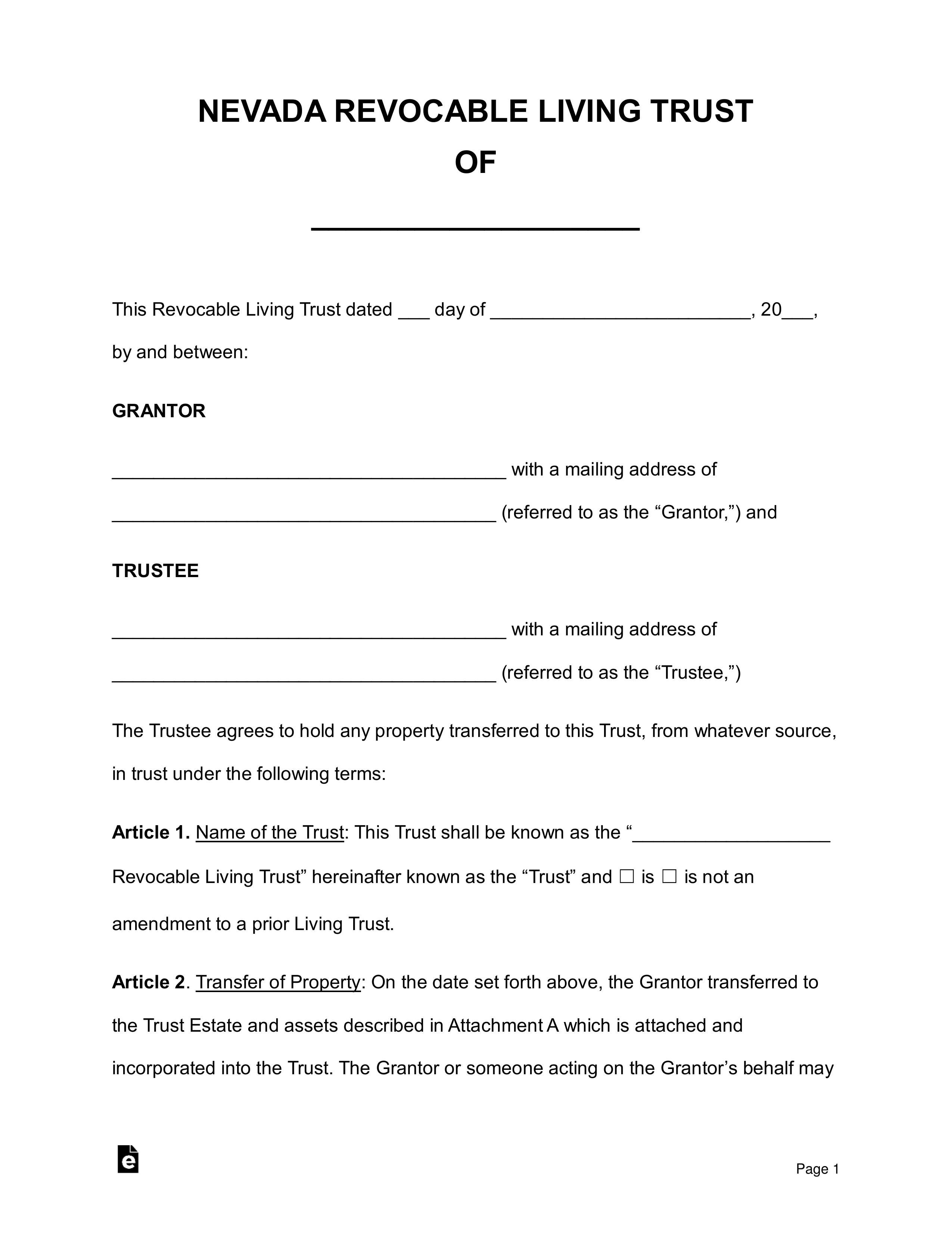

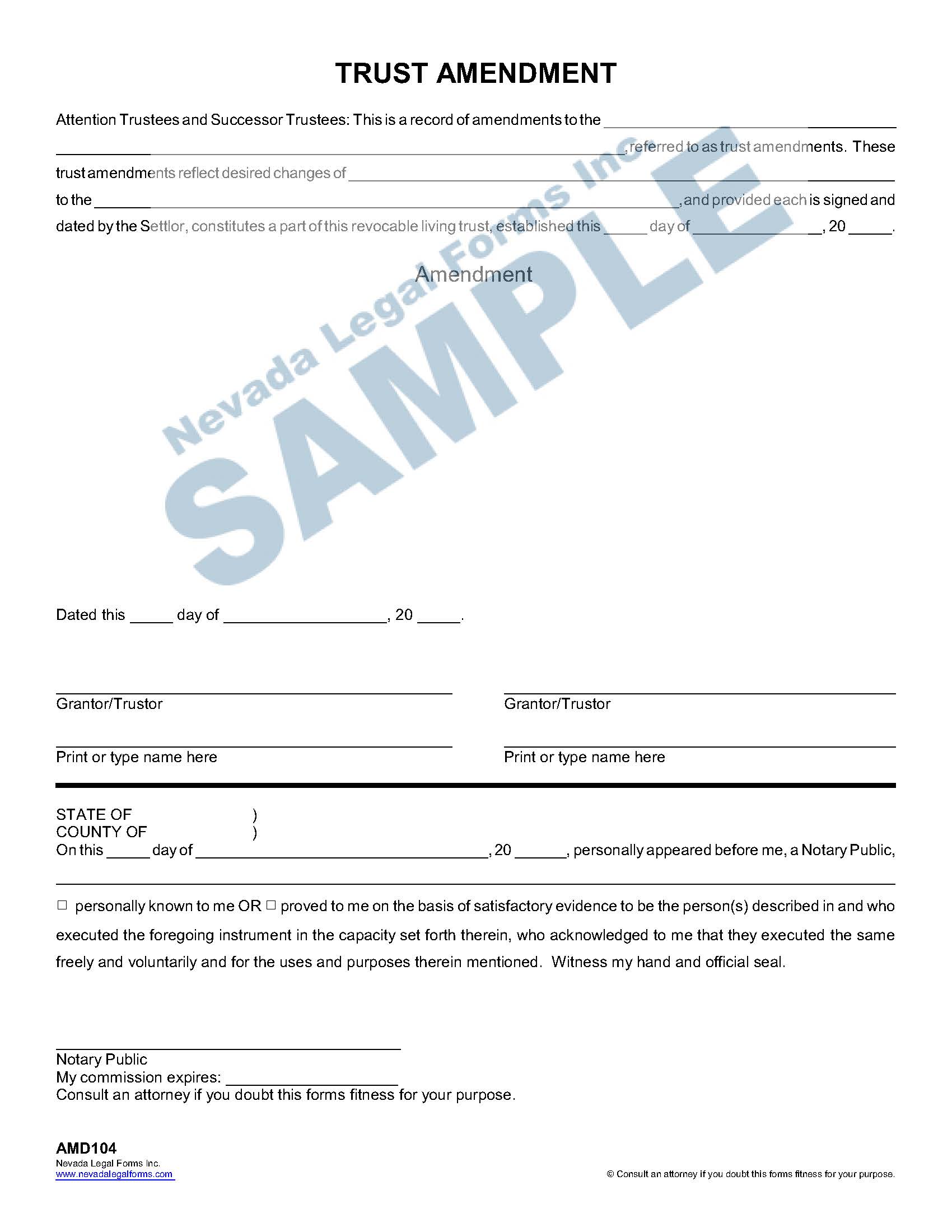

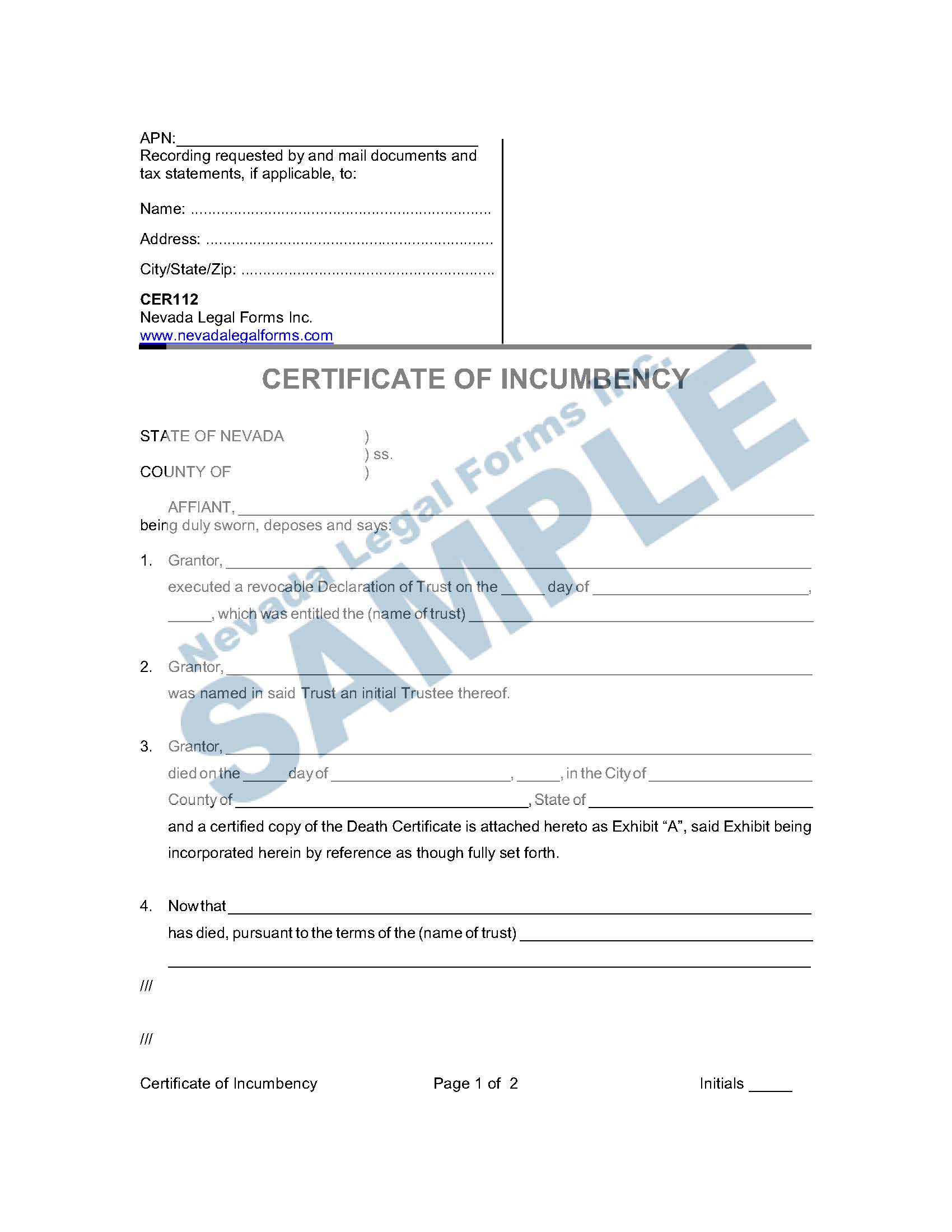

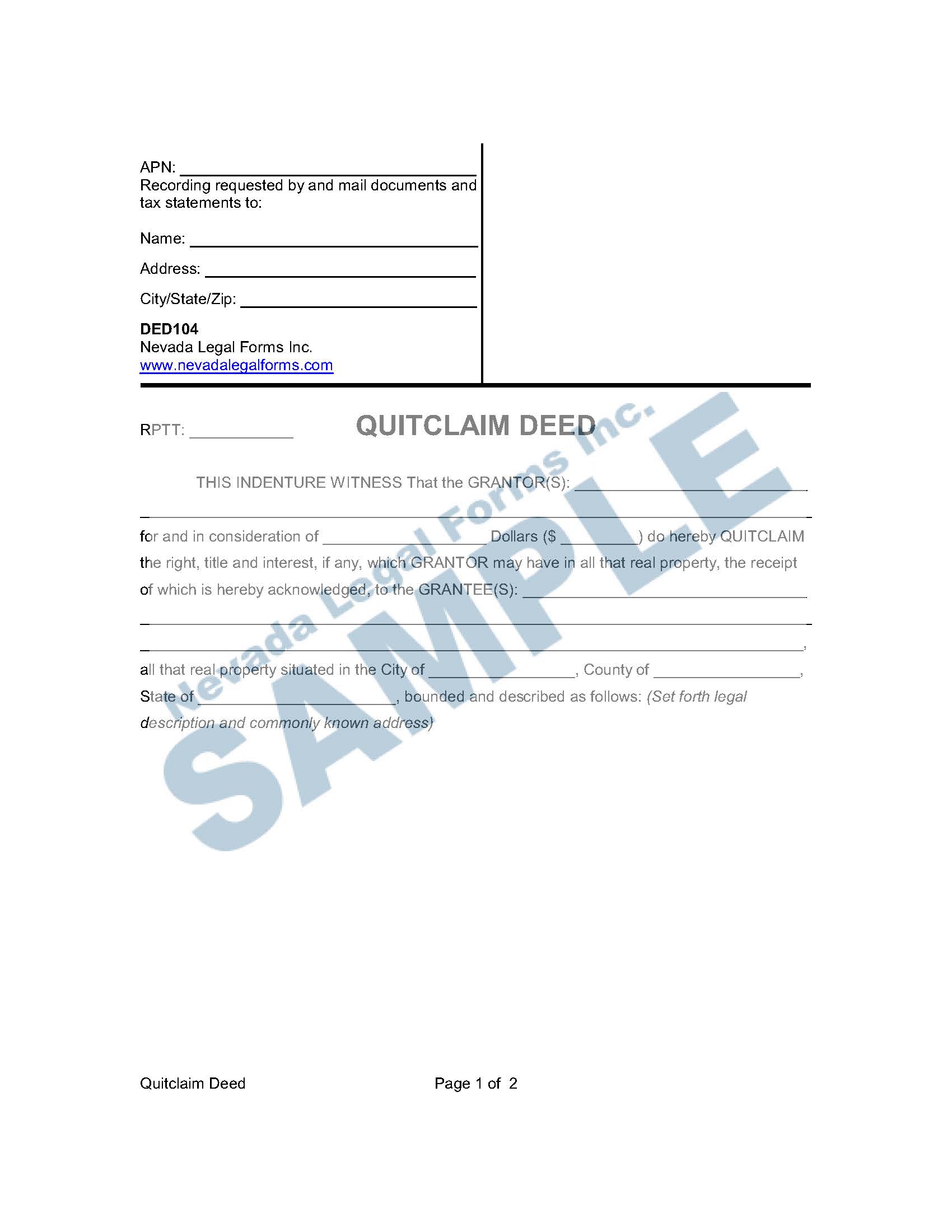

Our revocable living trust package includes. Do i need a living trust in nevada. But do you really need a trust. Download this nevada revocable living trust form which is a document that allows you as the grantor to set aside certain property and assets in a spearate entity for the adobe pdf.

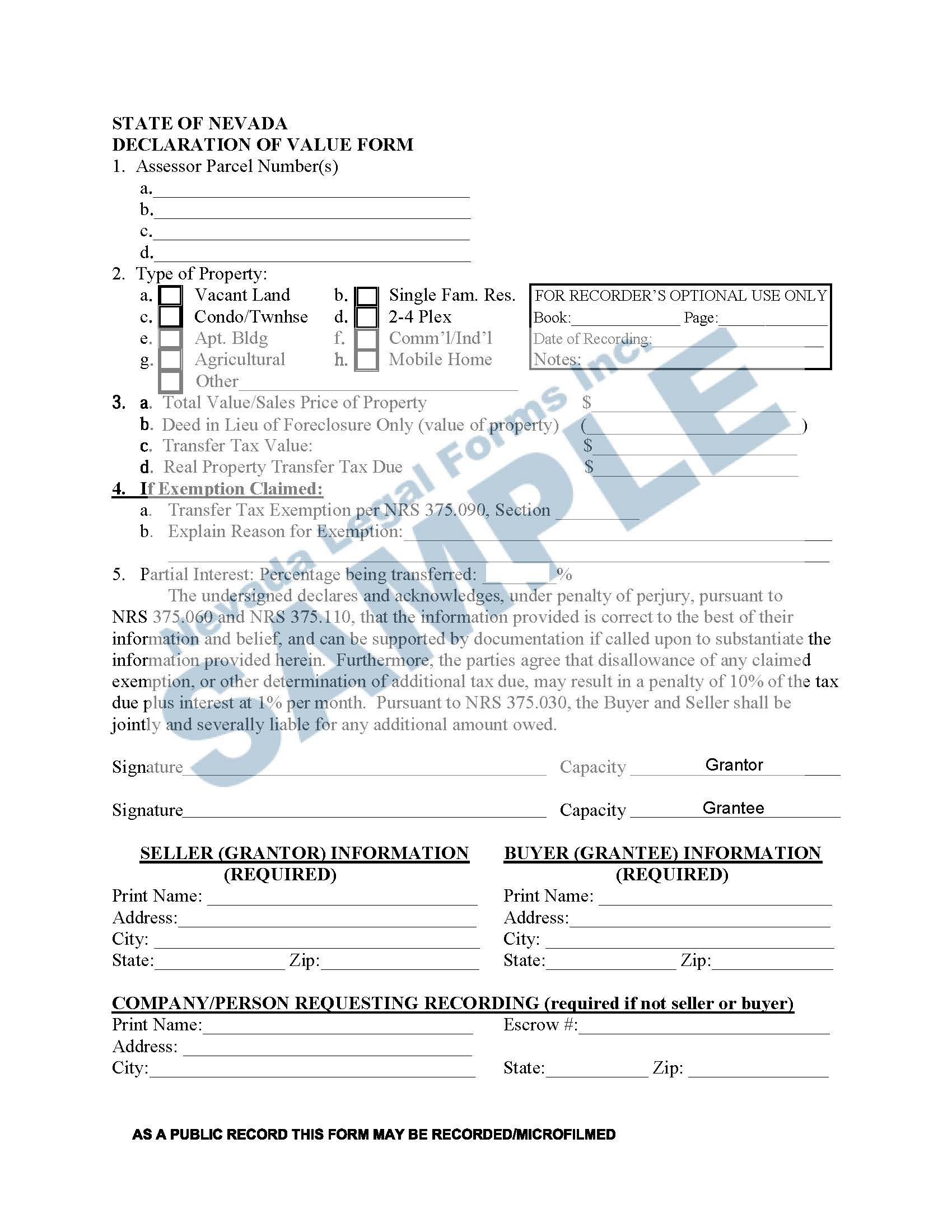

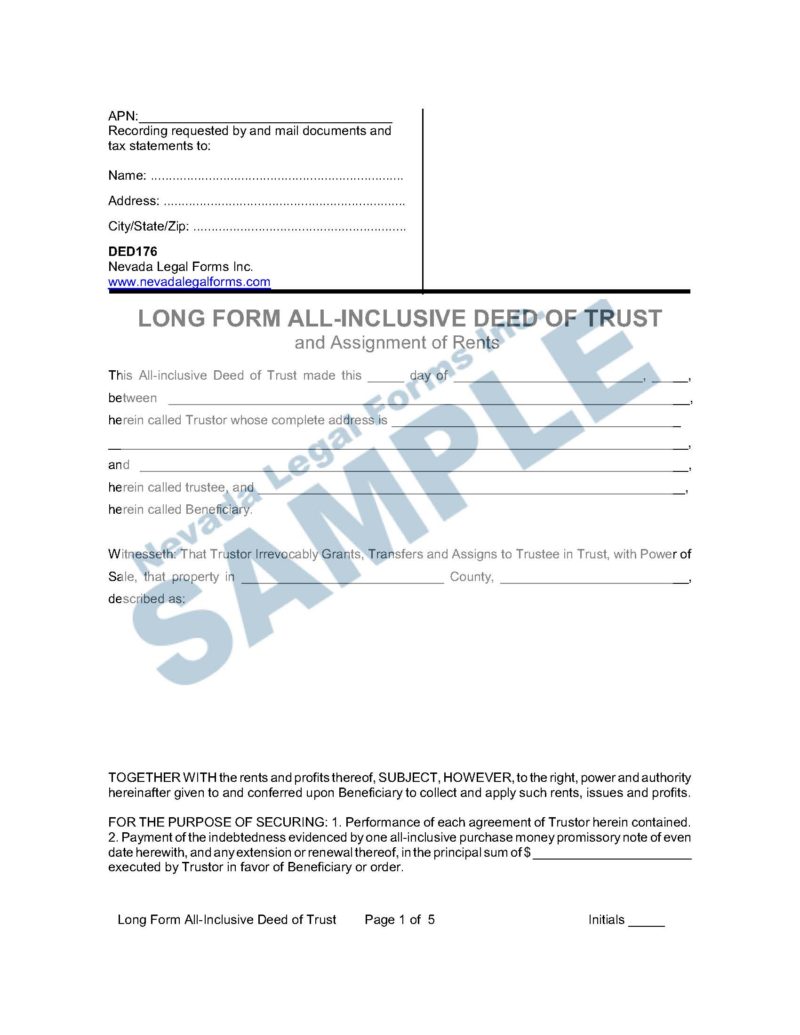

The nevada revocable living trust form enables the creator referred to as the grantor to place their assets into a trust so that their heirs can avoid probate when the grantor s estate is distributed while in some cases it can be more cost effective to use a standard will than to opt for a living trust the legal costs of maintaining a trust are often dramatically lower than the. A nevada living trust form is a legal document that controls the transfer of any property you have placed in the trust. Nevada legal forms inc. The nevada living trust is an estate planning tool designed to avoid probate while providing long term property management.

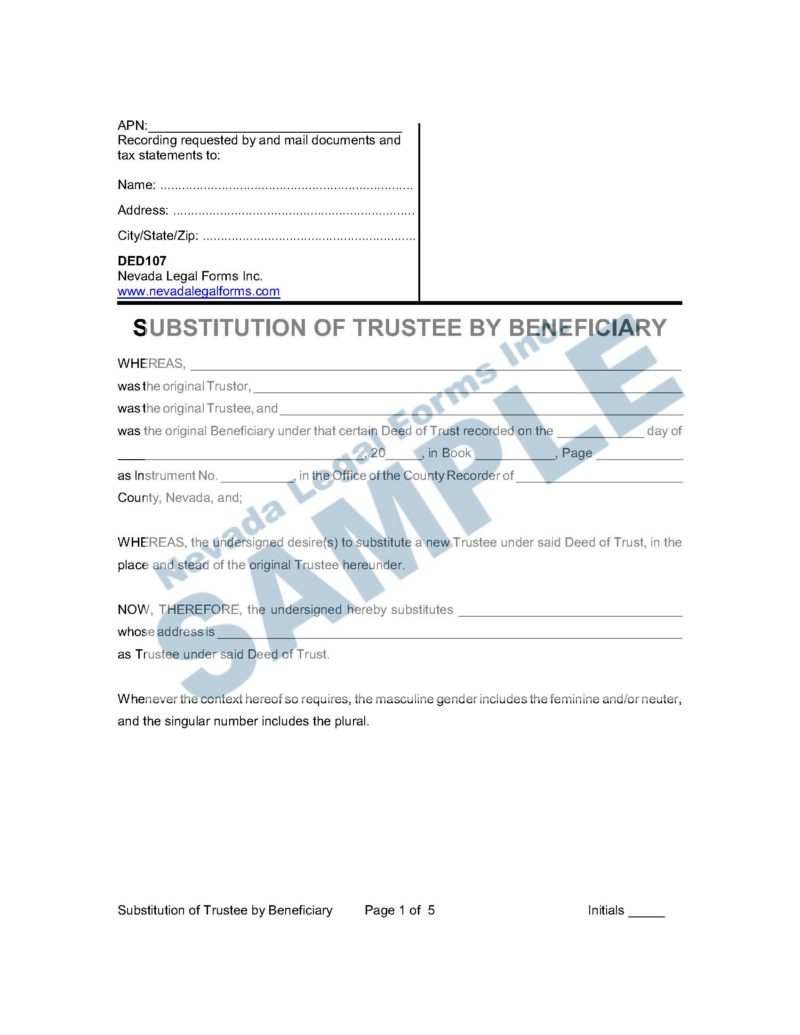

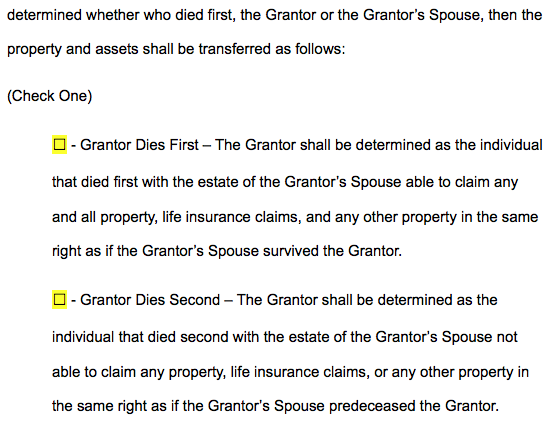

Nevada revocable living trust form. Nevada does not have an inheritance tax but the federal government applies tax to estates in excess of 5 million. Revocable living trusts agreement form this is the form to use if the intent of a property and assets owner is to construct a legal agreement between him as the grantor and another party as his trustee.